Latest SaaS valuation and why it loses its momentum

Remember the best days of SaaS, at spring and summer of 2021, despite whether it's public market or private round, the SaaS multiple even went up to the range of 50. SaaS multiple means a number resulted by the valuation of the company divided by its forward revenue.

Revisit its highpoint

SaaS model was pioneered by Adobe and Salesforce at early 2010, its advantage includes the consistent cash flow, subscription model to easily get users start and more agility on software development, comparing with the traditional model to burn a disc and need users to pay a big price at the very beginning.

The 2020 Covid-19 pandemic definitely sped up the adoption of SaaS software when so many people started to work from home – there're substantial more installations of productivity software, communication software and cybersecurity software. The darling crown belongs to Zoom, which enjoyed a 300% growth for several quarters.

The turning point

It started from spring of 2022, when the shadow of pandemic was fading, and more and more business realized they don't need so many software subscription, or need so many seats (most of SaaS subscription is by seat, instead of like cloud infra, by usages). It impacts the technology sector the most, as a big portion of these SaaS sales was to technology firms themselves, which triggered a downward spiral in the industry. So by fall of 2022 and winter, we had heard the news of those tech layoff, and internal adjustment of revenue projections of these SaaS companies.

How low is low?

At the summer of 2023, where are we right now?

- SaaS Capital’s recently completed 12th annual SaaS benchmarking survey which showed overall median growth for private SaaS companies is 35% with median net revenue retention of 102%.

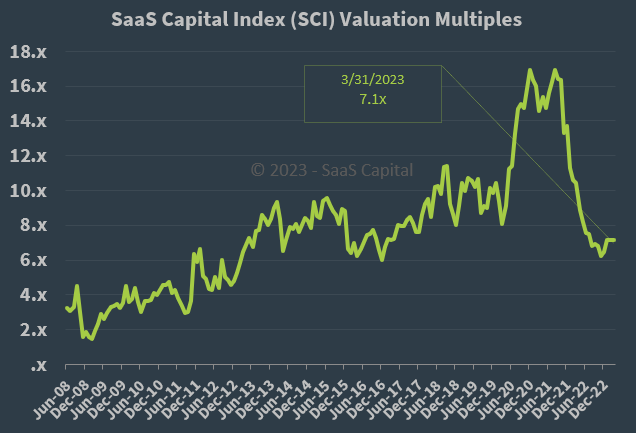

- The current public SaaS valuation multiple of 7.1x, as measured by the SaaS Capital Index on March 31.

Why SaaS is losing its momentum for the recent year?

- First of all, like lots of financial events happened in 2022 and 2023, interest rate hiked at a historical rate. That means the hurdle rate that these SaaS company's financial performance needs to beat is high enough – it's just rational that investor, no matter or public, they could simply invest in federal bonds instead of these stocks with risks.

- These B2B SaaS business stands on an assumption that their business is sticky enough that if their customers started to subscribe, it's so hard to de-couple, for example, software project management software, internal messaging software. This means their subscription's financial return is perpetual. However, when the shadowing of downturn is looming, especially a real tech recession happened, business find all kinds of ways to save cost. The natural one is to cut spending, and staff. In general, a business uses like 30-50 SaaS to run their daily operation. It just makes sense of the CTO or CIO of these business to look for ways to consolidate their software spending.

- Most of these SaaS subscription is based on seats, meaning how many number of users you see to a business decides your price bucket. However, with layoff, business needs to cut their seats, or moves over to some SaaS which is charging based on actual usage.

- The SaaS model was pioneered by Adobe and Salesforce in early 2010. I still remember when I was at MSFT at around 2013, there were efforts to move the Office suite to Office 365. Early on, I thought this was just a feature offering catchup war vs. Google's productivity suite. But later, realized the software subscription trend that Office executives were trying to catch up. The underlying economy of a SaaS business model comparing with the traditional one-off license model is that you spend your sales and market cost upfront, use an early lost money strategy to exchange for an hopefully forever subscription, also betting that your software will be even better, and customer is happy with your offering and growing their own business as well, so naturally you could do easy upsell or cross-sell (other offerings from you) on top of your platform. This metric is evaluated by this term net revenue retention – it measures how much revenue a company is able to generate from its existing customer base. Given that these foundation is shaking during this period, it's rational that the valuation is trending down.

How the pandemic darling is doing now

Last month, Zoom released their 2023 Q2 financial report, it only had a low single digits top line growth. Comparing with the 300% growth in late 2020 and 70% growth in 2021, it's definitely a roller coaster ride. By definition, it's not a growth stock anymore, despite all the struggles it has to try opening up the 2nd main revenue stream. Imagining a world that didn't have 2020 pandemic, the revenue of Zoom could be just growing gradually, though its adoption is relatively slower, but it will be on a more healthy trajectory, and its stock will be built on the basis of a more solid foundation, assuming time allows them to figure out more revenue streams besides only conference calls. Another way to put it – they were over-drafting their potentials through the last 3 years, and it's good and bad for its shareholders depending on when they jump off that roller coaster car.

Next steps of SaaS – my prediction

- SaaS multiple will be staying around 8x which is the level of 2017.

- The potential game changer factor could be what Generative AI would bring onto the table for SaaS companies. Some use case could be real and sold as an effective upsell, but some case could be just a "me-too" thing. Overall, it's a little bit too early to see this.

- The lesson learned through this period is always looking at the business fundamentals – SaaS business is not mysterious anymore, you cannot assume things like the perpetual subscription and its stickiness. Given the different sector it serves and its associated risks, you cannot use just one multiple number to cover the wide industry for its valuation projection.

Sources

[2] What's your SaaS company worth? https://www.saas-capital.com/research/whats-your-saas-company-worth/

[3] Zoom growth companies anymore? https://www.fool.com/investing/2023/05/27/is-zoom-still-a-growth-stock/