2023 Prediction

I probably spent too much money to subscribe all kinds of paid newsletters, and definitely not enough time to read through each single one of them. But at the beginning of the new year, I did reserve some time, and compiled some of the new year predictions I received among these blogs, podcasts, etc. In addition, I embedded my thoughts and comments there, and here goes Jinai's 2023 year prediction.

On AI

At the end of 2022, the generative AI attracted the attention of general public, and people realized how much improvement had been achieved in terms of these language models.

- It will definitely inspire a wave of startups in the industry to create some new experience. You can see a sneak peak from the daily Product Hunt top list, there's a new generative AI concept product every single day.

- But be careful, lots of these experience is an add-on offering on existing platform, and it has to get related to the core of the business – increasing revenue or cutting cost. If purely for fun, it won't last long. We will also see how Microsoft incorporates these technology into its Office Suite offering, and see how Google gradually rolls out its ChatGPT competing offer, but also mitigates the risk of due to the high cost of running the models and the public relations risk associated with incorrect or offensive answers.

- Just be careful of not make AI as another wave of Cryto in 2021 and blindly following everyone to jump in. Need to really think through the actual value it brings up. Reflecting on Ben Graham's quote:

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

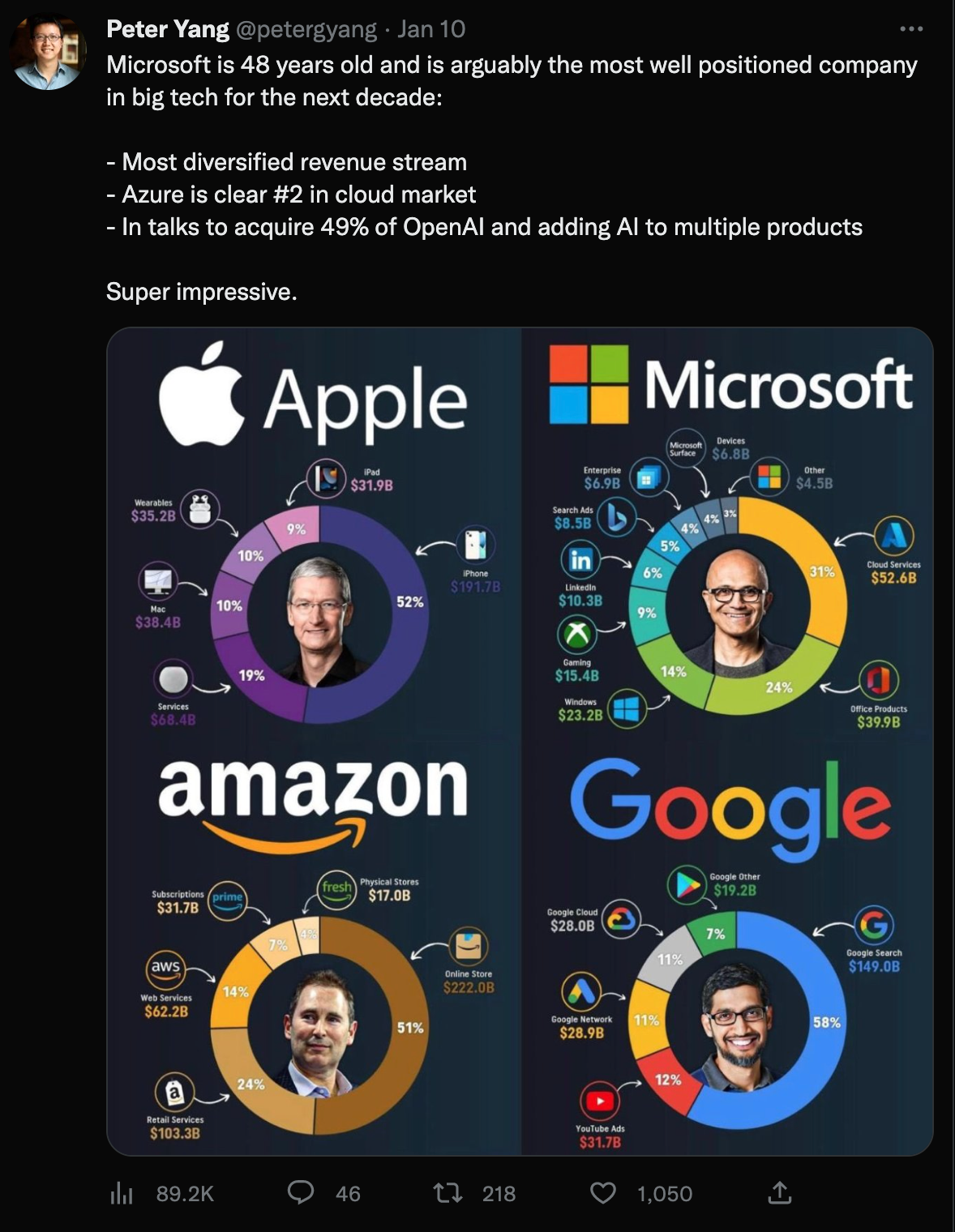

On Big Tech

The big tech are struggling on all fronts:

- Meta and Google: the decline of the ads driven model has been obvious in 2021, and both of their maturing ads business won’t be its growth engine in the future, say like 15 years horizon. Google is struggling of its cloud service division which during the pandemic era, carrying too much cost, and over the years, it's still No.3, way behind the other two major players. Google Cloud was original thought to lead the machine learning related usage for Cloud infra, and we have not see that trend really demos its advantage. Meta actually has the potential to come back to some extend, as the stock was too beat up during the last 2 months of 2022, let's see how they balance the spending on the Metaverse efforts.

- Microsoft is at a uniqueness position, we're looking at how it could integrate OpenAI to certain extend, and how they could settle down with FTC of its acquisition of Activision Blizzard. Microsoft is famous for sophisticated cost control and consistent execution, and let's see how it could navigate this troubling time. The wild prediction here is how they could really goes to B2C market, another shot on TikTok?

- Amazon will be even further targeted by FTC, and struggling to find its 4th pillar after e-commerce, prime and AWS. The big bet is supposed to be on healthcare, and let's see how they really utilize its recent acquisition to generate some real value in this industry, which should benefits end customers, just like that of the evolution on e-commerce back to 'everything store' days.

- Though superficially Apple seems doing the best among big techs in 2022, yet there're crisis emerging up. First, the consumer device purchasing power is decline globally with the looming recession; its efforts to try to move some of the manufacture out of China definitely would bring in certain inconsistency of its supply chain; and lastly, the 30% cut on Apple store fee have to be changed gradually, maybe even sooner in 2023 given the pressure of regulations. Apple needs to make some big moves in 2023, given its huge cash reserve – maybe it's the year Apple would make a big move to acquire someone to get into a new industry (buy a car company? 💁). In addition, the VR headset, lot's anticipation there, and we will further unpack it in a later section.

On Startup

All growth companies which requires heavy capital investment all face funding winter at this point, meaning companies after B round and haven't really figure out a path to positive cash flow.

However, this opens up an interesting open space for seed and A round companies, so 2023 will be a golden year for investors who would like to start to bury the seed for really early stage companies. Also, the craziness from pandemic year accumulated enough dry powder for them: used to be the case when investing late stage companies, they have to write a $50M check. Now, they can use the same amount to invest in 10 companies.

Like the 2008 financial crisis gave birth to AirBNB, Square and Uber, etc. Smart investor won't miss this opportunity; However, entrepreneurs who dare to launch the endeavors also need to go through some tough time to prove their business is viable and venture scale, also could stand out from the crowd. Bear in mind what VC-investable compaines means at this new era, a totally mindset shift from the last 10 years.

The second topic is when the IPO window would open up again. A super optimistic prediction from someone is later of this year, probably starting with Databricks and Instacart; however, an even wider prediction is the IPO of Elon Musk's Starlink. Not like a traditional software business, choosing a different class of companies to go public could be an interesting ice breaking point for the public market.

On B2B SaaS

The theme for B2B SaaS is changed – as a seller, you need to show the buyers the purchase is really essential, and need to show them it's time-to-value is instant. Starting from the early days of subscription SaaS of Adobe and Salesforce, this business model has been a genius type for the last 10 years – 75% gross margin, 40% profit margin, mature playbook, and publicly recognized multiples have been the signatures of this well-known model. However, during this hard time, companies are thinking twice when renewing that contract, and also when some internal people prepare to ink a new deal, it has to well prove to their leadership why this software usage is essential.

The same thing applies to cloud infra spending. A lot of companies now put their cloud infra cost under scrutiny, and finds all kinds of ways to save at that front, even back to self-hosting option.

On political topics

Domestically in the U.S., this year will be the ramp-up for the republican party's primary. We know there's one candidate already announced publicly he would run (everyone knows who he is 😏), but a big potential rising star goes to Ron DeSantis, the Florida state governor. There will be lots of drama to watch about how Trump sabotages his little brother.

Then, it's the Ukraine war – whether in 2023, each party would like to seriously sit down to talk to make a compromise. Especially after this winter, seem like the natural resource card didn't become a real constraint to Europe and hopefully this geopolitical crisis could be settled down to some extend sooner.

On Semiconductor

In the autumn of 2022, the U.S. issued the by far strongest control to export advanced chips to China, it's interesting to see how this would play out between these two giants:

- One part, with the CHIPS Act in place, it's interesting to observe whether it's really feasible to move chip manufacture back to the U.S.

- On the hand, how China could leverage domestic capabilities to build its own chips, also maybe find a way to structure deals with other big players, Holland and Japan.

- Lastly, good to obvserve how TSMC's 3nm technology's development, and whether humanity could further advance the state of art on chips.

- In addition, recommend this book if you havn't see it, quite fascinating read.

On AR/VR/Metaverse

I think all eyes are on, especially the people in the industry, the rumored Apple Glass. Some news indicates there could be a developer preview in late summer, and maybe a first wave of shipping during the holiday season of 2023. Yes, this is a really needed breakout for Apple, but can literally go either way depending on its quality.

Also, interesting to observe how Roblox is doing in 2023 if you categorize it as part of Metaverse. Its value has been cut in half from its high point, but its retention is high among young kids. Maybe it could become an acquisition target in 2023 (open a position now? 😉).

On consolidation

As the public market valued down lots of growth assets, or slammed them down back closer to their reality level, it's good time for lots of consolidations to happen in various verticals.

- Streaming

In the last 3 or 4 years, almost all media companies rolled out a streaming service, just like every B2B companies became a subscription business 7 or 8 years ago. However, that transition itself is not a silver bullet of new revenue streams, there're lots of costs associated with it, especially original contents spending as well as opportunity cost to not have your existing contents to host in other platform to earn extra money (It's like I don't want take money with low variable cost now, instead, I have to spend extra fixed costs for an unforeseen future). In the industry, only Netflix seems like figured out a way to flat cost on original contents (see my previous article), other players are still using existing contents and cheap starting rate to lure customers. In additional, interesting to see how Netflix's ads support model plays out this year despite its a bit discouraging initial results.

- Among companies

Many companies are actually becoming acquisition targets, even the ones which are already becoming public. Here're some wild predictions:

HashiCorp – Microsoft?

Rent the runway – Amazon?

Peloton – Apple or Amazon?

Commercial real estate in tier-1 cities, like San Francisco – by the dry powder of big PEs

More predictions here for M&A

Conclusion

Just like at the beginning of 2022, the biggest two stories of the year: Musk's Twitter takeover and SBF's FTX overnight collapse were not projected at all by most people, the biggest news could go really wild in the year of 2023 in a way people didn't anticipate. Let's see how this roller coaster year would unfold itself.

You're here and be present!

- Jinai

Resources:

[1] All-in podcast: https://www.youtube.com/watch?v=M3UjMit3xGY

[2] generalist: https://www.generalist.com/briefing/what-im-watching-2023

[3] the information 2023 prediction: https://www.theinformation.com/articles/the-informations-2023-predictions

[4] Professor G 2023 prediction: https://www.profgalloway.com/2023-predictions/