Shopify's Deliverr acquisition is a win-win deal

As I was previously working at E-commerce domain, Deliverr is a star company in that area. Middle April, there was the rummer that Shopify would acquire Deliverr for $2B+ value, and early May, this news was confirmed eventually (final price was $2.1 billion, and consisting of $1.7 billion in net cash and $0.4 billion in Shopify Class A Subordinate Voting Shares). In this article, we analyze from both sides on why this deal makes lots of sense, and could open a new door for Shopify's next move.

Shopify becomes serious on fulfillment network

First of all, customers are largely spoiled by the 2-day delivery which is becoming a standard for e-comm, thanks to Amazon. Most of the merchants on Shopify are D2C brands, and they're selling on multiple channels. If they do have a choice, they wanted to sell via their own website (mostly Shopify) instead of selling on Amazon, due to the high margin. On the Shopify side, they already lowered the bar to make building an e-commerce website so easily, and they've pretty much pulled of the Shopify payment solutions, the next frontier is naturally providing a fulfillment solution. Whoever can truly turn the fulfillment as an advantage than a cost center business could substantially gain advantage on this e-commerce war among these giants.

Secondly, Shopify had been built its Shopify Fulfillment Network (SFN) for quite some time, and this acquisition definitely sped things up. We can see after the deal, the SFN website is advocating some features which is obviously empowered by Deliverr's core offerings –

- They claims that they could give business a competitive edge with two-day delivery verified by Shop Promise.

We distribute your products to fulfillment centers across the United States so we can delight your customers with fast, affordable deliveries.

2. Simple pricing is another advantage – an estimation cost is key for merchant to plan out their inventory. SFN declares it builds with a predictable price that covers inventory management, delivery, and free storage for every item sold within six months, with no up-front costs.

3. It's getting to the full service model that Amazon has. The slogan it uses now is: you make the sale, and Shopify handles the rest. This was way advanced than it was back to the days that Shopify is just another Wix or SquareSpace for merchants to build an online store themselves.

4. It also uses a pay-as-you-go model to further easy the entry bar of merchants to try out these fulfillment offering. Also, it supports international shipping (guess it's not two days for intentional)

Why Deliverr wants to sell itself now, though potentially it could sell more

History of Deliverr

Deliverr is the role model company in the fulfillment domain of the e-commerce business. It was founded at 2017, and was successfully raising one round every single year afterwards.

They're the first well-known independent fulfillment provider for a fully managed fulfillment service, and the well perceived message they crafted is that they could provide 2-day guaranteed delivery in continental the U.S. for e-comm D2C brands. They take merchant inventory, and pre-deploy them to warehouse that they rent in different parts of the country. The so-called mid-mile delivery provider. They declare they use ML which could predict the optimal way to distribute these inventory. In terms of the software interface, they provide a pretty modern B2C comparable experience, so merchants could pretty much self-service and browse where their inventory are deployed in real time.

Their growth trajectory was absolutely sped up by the pandemic, due to the never seen adoption of e-commerce in the US. Most of merchant, when they reach over $3M GMV, they definitely realized the necessity to sell in multiple channels, and don't only reply on Amazon and its fulfilled by Amazon (FBA); However, as mentioned earlier, customer has less tolerance to receive goods brought on D2C website way slower than bought on Amazon.

Bottleneck of customer acquisition and cooling down of e-commerce market

After the hyper growth during the pandemic, it was obviously a cooling down since spring of 2022 for the market, especially for e-commerce. Customer acquisition is getting higher, and the cycle for closing a merchant customer definitely gets longer and longer when the targeted merchant segments gets bigger and bigger. Also, it's a heavy assets business that needs to burn lots of cash to reserve warehouse, and takes time and money to keep optimizing a better way to distribute inventory.

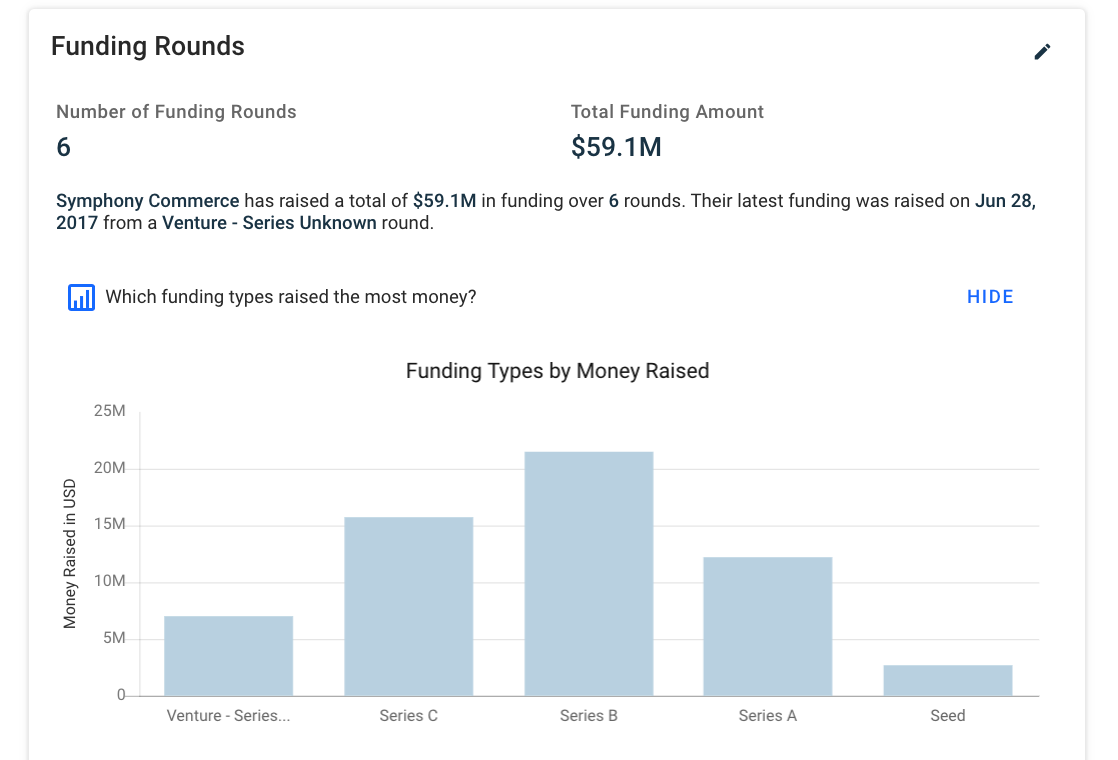

Founders

The founder combination of Deliverr is very interesting pair – Harish Abbott, an e-commerce veteran and Michael Krakaris, who made the Forbes 30 under 30 list in 2019. They were former colleagues at Symphony Commerce which was co-founded by Harish in 2010. Symphony Commerce was pretty efficient when it's about allocating the venture capital - almost raising one round every year; until 2016, unfortunately, it had a down round (don't know the reason), guess that's when Harish and Michael started to bake the idea on fulfillment side. That playbook of being acquired had been exercised well back to the Symphony Commerce days, for them, at the right timing, selling to Shopify is definitely a level up who currently represents the zeitgeist of e-commerce of our period.

What would happen next

There're lots of copy cats of Deliverr, naming a few: Shippo, ShipMonk and ShipBob, etc. What are they doing now? Guessing in this environment, they're doing their best to reality check on M&A, and probably all eyeing on Walmart. In addition, we only talked about the one way delivery, don't forget the other way - returning, that's also a tens of millions dollars market.