What's Temu, the only brand running 2 ads in this super bowl

Temu is the US latest NO.1 downloaded shopping app on App Store, and it was quietly launched half a year ago. But this time, lot of people got to know its name due to the ads showed in last weekend's super bowl 57; that being said, there're two interesting uncommon practices from its ads:

- The ad got repeated twice. Super bowl ads are famous for how notoriously expansive it is – a 30-second ads could cost $7 Million, and Temu got showed twice, in the first quarter and third quarter.

- There were rarely any Chinese companies previously sent its ads to the super bowl which is the most viewed event in the US, someone even compare it with the CCTV's lunar new year Gala in China. Also, this occasion is believed to be the colosseum for anyone who works in the ads industry – you need to maximize your creativity to make sure your commercial does standout. However, Temu made such a relatively low quality ads comparing with ours, and further even repeat it twice – the 30-second commercial is titled as “Shop Like A Billionaire.” It follows a young woman who is amazed at the cheap prices on clothing and accessories that Temu has to offer.

“The prices blow my mind. I feel so rich. I feel like a billionaire. I’m shopping like a billionaire,” goes the ad’s jingle.

Though the ads were poorly produced, types of audience of the super bowl are varying drastically, maybe to whoever it's targeting the message does resonate to some extend!

What's Temu? and who's behind it?

Temu is the dedicated app for the US market owned by Chinese e-commerce giant, Pindoudou Inc. which is also a US public listed company. It has been flooding many people’s social media feeds in recent months and offers a reward system of product credits when getting friends and family members to sign up and place orders.

Pindoudou is famous for its group shopping feature, as known as social shopping. They setup a a minimum quantity of the product in a discount price, if the quantity is not met in limited time, the deal is off. So when people start to buy, they have enough incentive to send the deal into their social network, and the more people joining, the deal could get even cheaper. Pindoudou used the same gamification approach to crack out the dominance of JD.com and Alibaba in China, and in reality, most of their targeted demographic are in tier-3 and lower cities.

Since its launch of half a year ago in the US, they utilized social network, especially TikTok marketing pretty effectively, and it's definitely a hot start. Regarding the business model, in contrast to the unsuccessful practice of live shopping of TikTok in western countries, they seems like gained a way better traction so far.

Who Temu is mainly targeted to and how effective that target is?

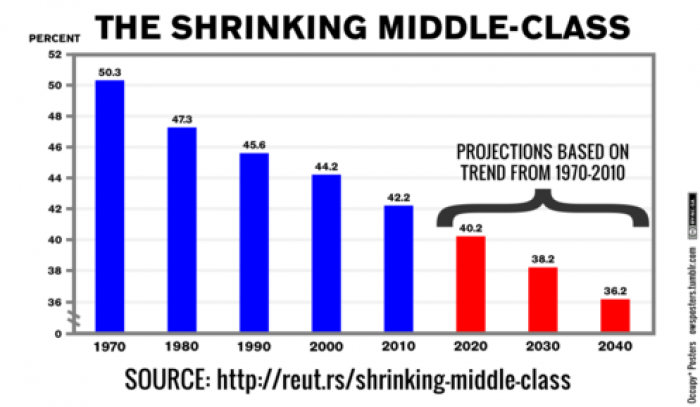

I would think people buying from Temu is just like they wander around in their neighborhood dollar stores and go shopping there. One drive is the economic reason, as goods there are just insanely inexpensive. The US disparity between rich and poor only got expanded through the last pandemic – Federal Reserve data indicates that as of Q4 2021, the top 1% of households in the United States held 32.3% of the country's wealth, while the bottom 50% held 2.6%. In contrast, the middle class, once the economic stratum of a clear majority of American adults, has steadily contracted in the past five decades. The share of adults who live in middle-class households fell from 61% in 1971 to 50% in 2021.

On the other hand, people have different quality expectation for goods. Back to the dollar store example, you wouldn't expect the things you bought there would last for years. Same as the clothes you buy from Temu, or another sister Chinese based app, Shein, these type of goods are meant to be fast fashion, only good for one season, and probably only could be washed less than 10 times.

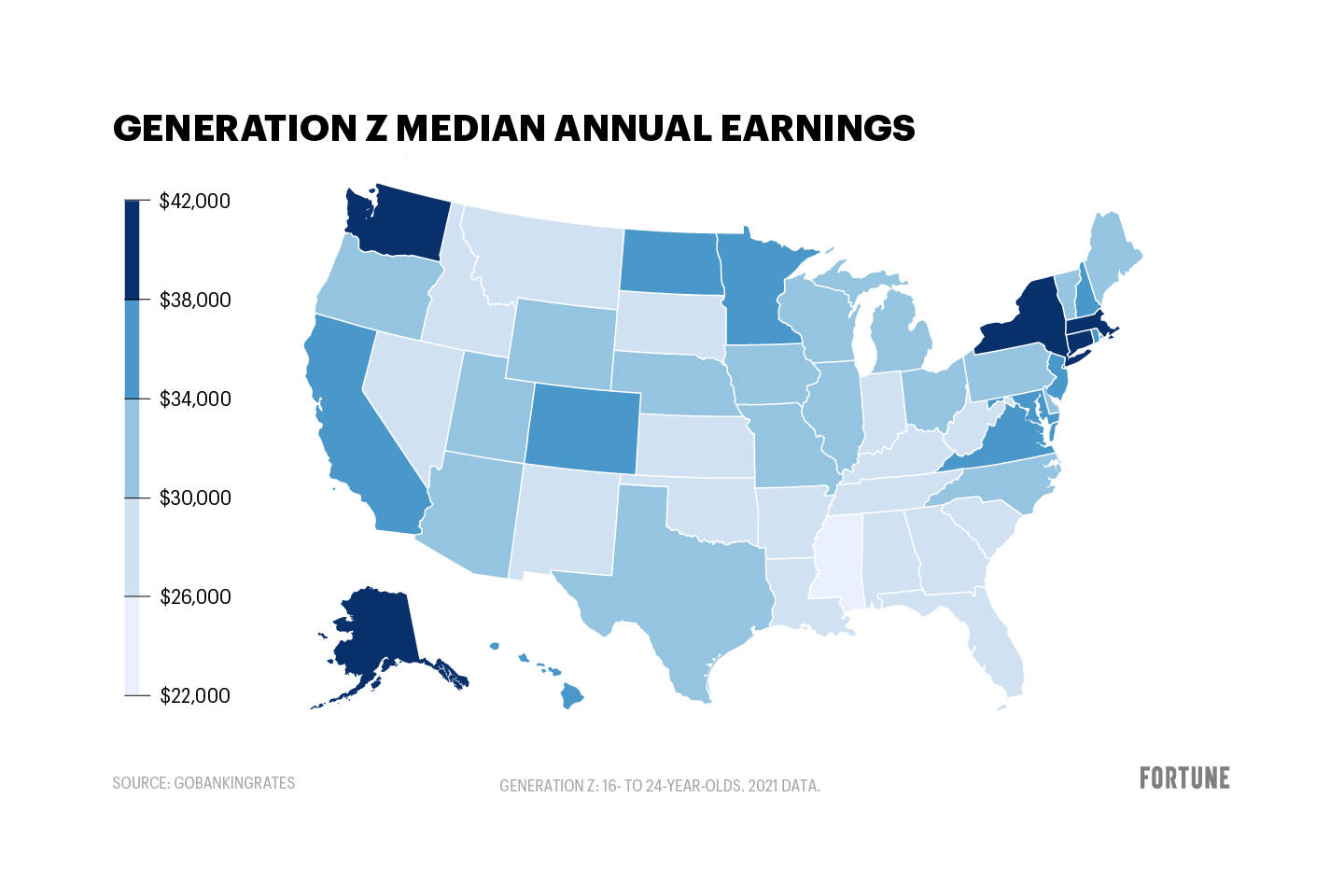

In terms of what segment of customers these apps are targeting, they're particularly targeting GenZ. GenZ is the generational cohort following millennials, born between the late 1990s and early 2010s. They're major the consumption of fast fashion, and are good to follow the new fast movements and trends on Instagram or TikTok; however, income wide – the median Gen Z salary is $33,800 per year, according to GOBankingRates. 65% of Gen Zers feel like they're living paycheck to paycheck.

With these limited resources, and the strong needs to go social with friends, where they could go? Naturally, it's platform like Temu or Shein – despite waiting for like 10-day shipping, they could get the best deal there. Even only 70% of the goods they received are at an acceptable quality level, still worth the wait and money.

What trends are they catching?

The matter of fact is the excess production of Chinese based manufacture, and not enough consumption domestically in China, especially through the Covid-19 period, so these Chinese manufacture have strong willings to go abroad. Used to be the days that they don't own brands but only producing for western brands, however, they realized to directly sell to customer that's how they could capture most margin.

Since 2016, on Amazon along, you could see more than 50% of the brands are Chinese brands (this well written article captured this effect pretty well), but Amazon does a big cut of those sales, and the brands have to firstly move the goods into those fulfilled by amazon warehouse in the US in the first place, which incurs another layer of costs.

The birth and popular of Temu and Shein enabled the direct mail from China based warehouse by these brands, and if the consumer could wait around 10-day or so, the price makes lot of sense.

But, do the really make money?

After super ball ads, seems like there's a small boost of number of downloads in the app store of Temu, but as the app has been already top 3 for some time, the effect is not so obvious.

Also, what interesting is the message of Shop Like A Billionaire is also one that doesn't land well with the current US culture where people don't like the super riches. However, by following the playbooks that had been running well in China, and precisely targeting the GenZ generation, Temu and Shein are having a bright potentials and should gain more and more market shares in the US.

In terms of becoming a dominate platform, following the article I posted last week about the "tnshittification" theory . It takes time to train consumer behaviors to have your platform to be the go-to one to search when they're thinking about owning things, but once that's done, that's when the platform is good to boost bottom line from both consumers and supply side.

Lastly, for now, there's another advantage of Temu and Shein to directly mail from China. If customer chooses standard shipping, and keeps their order less than $100, lots of times, they don't pay the import tax. It's very likely this rule will change, but until then, that's another edge these apps could explore.

Conclusions

The US is famous for its diversity, and different segments of customers. To enable these normal people to purchase these more affordable goods are a better thing anyway. It's just that in terms of regulation, hopefully there's just enough rules enforced to protect the customers to avoid certain risks (for example, some electronics resulting in fire damages); as long as the consumer set the right mindset, and this could be a win-win situation for both sides.

References

[1] https://www.cnbc.com/2023/02/13/super-bowl-2023-temu-ads-launched-by-chinese-e-commerce-giant-pinduoduo.html

[2] https://www.forbes.com/sites/emilymason/2023/02/13/temu-social-shopping-app-already-a-winner-kicks-off-us-campaign-with-super-bowl-ads/?sh=5a1cfdcd7a80

[3] https://time.com/6254985/temu-super-bowl-ad-criticsm/