Why it's so hard for Netflix to ban password sharing?

How's Netflix really doing these days?

It's been roller coaster year for Netflix – from beginning of the year, the stock has been down more than 50%. Especially at the Q2 report, it reported lost of subscribers, the first time in its history.

Though it made some levels of come back at Q3 (so as its stock), yet a lot of people wonder how Netflix is really doing financial wide these days?

In 2022 Netflix will generate about $30 billion in revenue. The average revenue per subscriber, the average member pays per month, is about $11.85. That varies pretty broadly depending on the geographic region.

Netflix is famous for its original contents and also bridging and mixing contents among its global market (it's always better to listen to the original sound track of Squid Game, Money Heist, etc). This year, its spending on original contents will be about $18 billion. It's about 60% of revenue. Cost wide, it includes three categories of operating costs: Marketing costs, which will be about $2 billion, 6.6% of revenue; technology and development, which will be $2.6 billion, 8.6% of revenue; and then G&A, which will be about 5% of revenue.

If you add up the operating cost, marketing, technology and development, G&A, it will be about 20% revenue. So you end up with $30 billion of revenue, less $18 billion of cost for content and about $6 billion of operating costs, you get to an EBIT margin of about 20%.

For the future, the assumption is that they would probably keep the same level investment of the original contents; on the other side, trying to acquire as many as subscribers possible, and that will keep increasing its revenue. It's like building a theme park – they spent 10 years to build up, and figured out a secret source of spending more or less the same level fixed cost for attractive hardware, while keep charming customers. So the focus of next step is to make sure new comers can start coming into the theme park, and make sure the previous customer keeps coming back – maintaining the recurring revenue.

Then, what's the upside really there for Netflix's new customer acquisition?

One reference comparison is that the paying television market in the U.S., just linear cable, topped out at about 100 million paying homes. So Netflix right now has, between the U.S. and Canada, about 73 million. So the challenge for them is how they can convert the 30 million households that are not paying for the service into paying customers?

The tricky part is that a large percentage of the 30 million households might be already Netflix customers, but not paying customers. How come? the key is password sharing. These are the people already watching Netflix in the ecosystem, they're finding values from the content, so the challenge is just getting them to pay. Although as a company owning so much tech talents, isn't it just too easy that they could crack down the password sharing and force converting these customers? No, there're certain interesting dynamics at play here.

Certain dynamic interests at play

The full number is about 100 million plus households around the world are using someone else's account and not paying. So on the spectrum of problems, it's a good problem, but it is still a problem because there's a lot of viewing that's not being monetized.

Things were NOT like this before – back to early 2016, CEO Reed Hastings said that consumers sharing Netflix account information was “a positive thing.”

Yes, there're always this business cycle things going on. Netflix started streaming probably 10 year ago, and 5 years ago, the momentum is to build the "addicts" by exposing its product, brand and shows to more people. The example Reed gave back then was kids used to share accounts with parents, but when they grow up, move out and been financial independent, they will start to have their own account, and don't want to expose their viewing history to their parents.

Well, this could be true at that time, but business's world is changing so quickly. With the upcoming intense competition from every entertainment competitor, as well as the adoption penetration has decelerated. The growth pressure from inside and external wall street investor has pressed the company to change its view to explore the next frontier of customer acquisition.

Based on the customer acquisition flywheel, it's also making sense, timing wide.

- Customer has been addicted to Netflix's services. If someone has to choose one entertainment service, there's a high chance the top choice is Netflix. Especially its app usage experience, it's for sure the state of the art, and you could move among difference devices so fluently.

- Netflix has almost figured out the rhythm to make sure the original contents they produce cost less than $20B a year.

However, the bottom line to really monetize this transition is not pissing off your customers. As with any subscription business, the real objective of the business is to maximize the lifetime value of the customer. This requires Netflix makes bold strategic move, and focus on the long term.

By doing so, Netflix introduces several middle grounds – for example, ads support tiers, as well as helping customer to move profiles. We will explore this techniques in details in later part of the article.

How to prevent a password sharing, is it a solvable problem?

Here's the official guide on sharing netflix. It basically allows:

- People under same household to share Netflix, creating their own profiles.

- First time usage, it needs some verification approach, like sending a link to your email that you have to click in 15 mins. If within the same household, even changing devices, they don't need extra verification later on.

- However, if traveling to other location, they need to conduct verification again. And they repeat this randomly, depending the level of "suspicion of password sharing".

But there's always a catch – if I travel to my relative's home, and use my password to view the service, as long as I always help to complete the verification step every time later, my relative can technically watch it forever, for free. Netflix declares that they use a combination of information such as IP addresses, device IDs, and account activity from devices signed into the Netflix account.

In general, it's a blurring area to detect password sharing. It's like detecting those network security issues, which is always associated with a confidence score. And it's a balance between smooth usage and being over cautious.

Across the industry, the techniques to detect password sharing are as follows:

- A combination of behaviors and context.

- Enforce the 2nd factor authentication. But it's a balance between easy usage and security. Over protection would downgrade the usage of the app, especially on mobile devices.

Again, this is an area, given Netflix deep talents pool, they could definitely come up solutions way better than their competitors. Just like how they had been improving their recommendation engine, this password-sharing detection engine just need time to get better; however, this it also this business perspective at play, as you really want this detection to be really accurate. Any false positive would hurt customer experience and it needs other approaches to supplement this transition and hope customer is willing to convert to paying ones but not forced to. Bottom line, gradually tight the threshold and monetize these potential users instead of churning them, as they might be the most price sensitive groups.

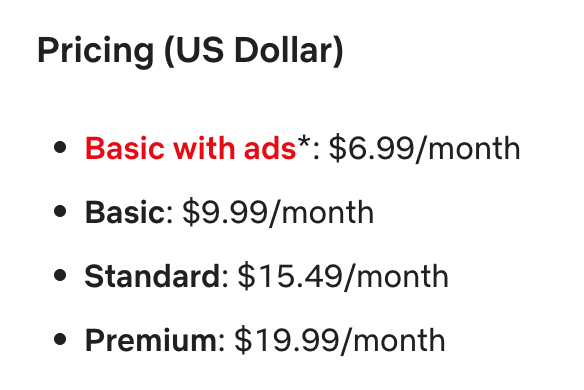

What's the alternative solution – the Ads tier

Since November of 2022, Netflix rolled out the ads support tier – it's $6.99/month in the US. It requires to watch on 1 supported device at a time, and probably watch 4 or 5 minutes of ads in an hour. The ads are said to be curated to guarantee the quality, highly targeted and the measurement is good.

In the very latest news, seems like this plan didn't go as planned so well: from wsj.

Netflix’s new ad-supported plan was the least popular tier of its service in November, the first month in which the streaming giant offered it, according to subscription analytics firm Antenna. The plan accounted for 9% of new Netflix sign-ups in the U.S. during the month. Some 57% of subscribers to the ad-supported tier in the first month were people re-joining the service or signing up for the first time, while 43% downgraded from pricier plans, according to Antenna.

I think it still needs several months to see whether providing this tier could be a good middle ground to convert the password sharing customers.

The other low-ramping approach Netflix provides is the support of profile transfer. This makes sense naturally to make it smooth for any customer when they move from a password sharing violator to a legit subscriber, no matter which tier it ends up with.

What we're watching for Netflix in 2023?

Netflix has been a resilient company and had a spots team performance-oriented culture. It had done four big evolutions in its history:

- The first one was DVD to streaming. The company was found as a DVD-by-mail company. And in 2007, they started streaming.

- The next big transition was going from a domestic business to an international business. So in 2010, Netflix entered its first international market, which was Canada. They know the potential of a good contents which are easily crossing the country boundaries.

- Then in 2013 they shifted from licensed content to producing their own content, most famously House of Cards.

- Now they're very early in the fourth big shift in the business, which is moving from a pure subscription model to a subscription and ad-supported model. So it takes a certain type of management team and a special culture to be able to make four big business evolutions or pivots, and Netflix has done it successfully.

However, the competition landscape is currently not easy for them:

- Used to be the days that Netflix is the only player in the arena, now, well-capitalized legacy media companies: Disney, Warner, Discovery, Paramount Plus, Comcast with Peacock have entered the market, and they have years' experience to produce original contents.

- As well as there're megacorp at play – Apple and Amazon, though their agenda is to promote their service bundles.

So looking forward, considering that them park example again, the goal for Netflix is keeping increasing their revenue while keep the cost relatively flat. For example, in several years, if its revenue gets to $40 billion.Its gross profit is about $20 billion. The rest of these teams of marketing, R&D, sort of stay proportionate. And that yields $10 billion in EBITDA margin.

In the meanwhile, trying to generate new revenue streams – for example, games which you probably already seen when you use the app, and this week, they started to stream fitness contents.

Given its track records to navigate the previous crisis, its culture and persistency, Netflix is still having a high chance to pull this one off.

References

[1] business breakdown on Netflix: https://www.joincolossus.com/episodes/99430832/weiss-netflix-the-original

[2] Why Netflix Should Sell Ads: https://stratechery.com/2022/why-netflix-should-sell-ads/

[3]https://www.reddit.com/r/netflix/comments/u8bw1c/how_would_netflix_determine_whos_password_sharing/